Norway is a mysterious land for the outside world. The general public associates the country with a

high standard of living, high taxes and historically the Vikings. However, beneath this rocky,

mountainous and desolate wasteland, a strange economic tale sits. Today, like a fairy-tale I’ll be

taking you through the mysterious world of the Norwegian Economy and Pension Fund.

The Norwegian Energy Sector

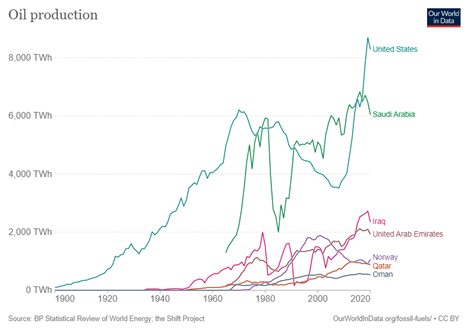

Norway is the eighth largest crude oil exporter, the third largest natural gas exporter and possesses

potentially the largest exploitable coal reserves in the world. Crude Oil & Gas, contributed to over

43% of the country’s total export value in 2016, with the sector contributing a total 17% of the

nation’s GDP. Norway’s story however isn’t fully unique, with many cases of nations with abundant

natural resources, namely Venezuela and the Netherlands. The differential factor, within our story

however, is highlighting how Norway avoided the mistakes of its compatriots, and setting a

metaphorical “Gold Standard”, for economic management.

The Venezuelan Story – The Anti-Norwegian Approach

Venezuela is known as a Petro-State, with the government being deeply reliant on revenues derived from the export of oil and gas, with weak institutions vulnerable to severe corruption. Petro-States, and most natural-resources reliant economies are vulnerable to a phenomenon known as the “Dutch Disease”.

Theoretically within the nation, a large resource boom begins attracting mass amounts of foreign capital inflows, in turn appreciating the local currency due to high demand which in turn leads to increased importation, as it is now relatively cheaper. As the nation begins to rely heavily on imports, labour and capital are pulled out of unprofitable sectors, generally manufacturing and agriculture, with a majority of the economies resources supporting the newly profitable sector. These labour-intensive industries begin to crumble slowly, due to a lack of support and therefore creates a spiral, where the economy is entirely dependent on global swings in energy prices.

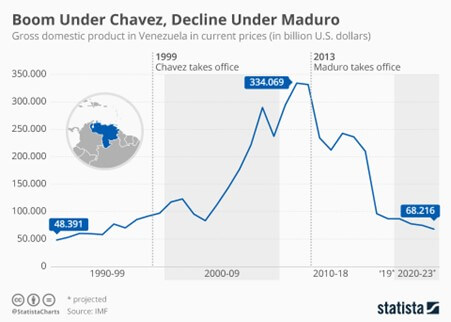

Venezuela was historically one of Latin Americas richest nations, it had a strong welfare system, high levels of military investment and strong technical knowledge. Under Chavez, the nation was shown by utopian socialist thinkers, as a shining example of development. However, Chavez’s policies of exorbitant welfare spending, the provision of subsidised oil to “Friends of the Revolution” and mass corruption imploded the country between 2014 and 2016. During this period, global oil prices crumbled from $100 USD to $30 USD a barrel, and with it the economy entered a recession, inflation ran at 1,949% and over 77% of the country entered extreme poverty. Venezuela’s over-reliance on oil exports, lead to a figurative “brain-drain”, in which highly educated individuals, fled the country to neighbouring nations such as Colombia, Bolivia and Brazil. This has exacerbated the nations issues, as domestic industries don’t have the educational foundation, capital or labour to restart competitive production.

Venezuela essentially couldn’t support its spending long-term, as a majority of government revenue was spent on artificially reducing poverty, through a stronger welfare state. The nation failed to increase investment, within educational institutions, non-oil infrastructure and the agricultural sector. Venezuela stood as a “House of Cards”, with the state failing to make adequate preparations once Oil prices fell, in order to maintain such living standards.

The Norwegian Approach to Economic Management

Norway, however approached the use of Oil in a truly Scandinavian way, aiming to use the resource for the betterment of society. Now in retrospect this sounds essentially like what Chavez aimed to do however the Norwegians aimed to do so, by increasing the resilience of other economic sectors. Norway initially used a majority of funds on technological research, in order to support other sectors by giving them a competitive advantage namely in mining and manufacturing.

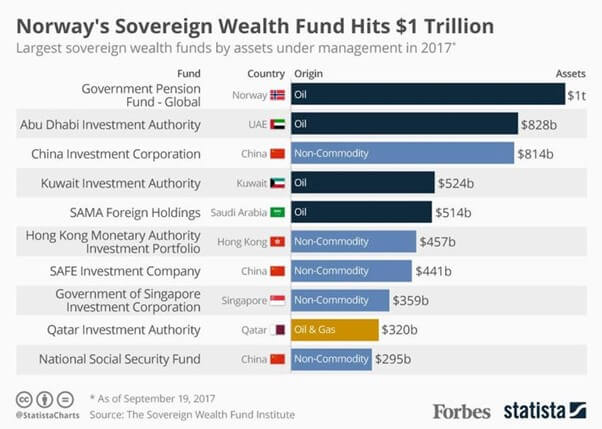

This however was not comparable to Norway’s “piece de resistance”, the Government Pension Fund. Essentially the system works as Oil Rents which are charged to multi-national firms, are not converted into domestic currency, the Kroner, instead it is deposited within USD immediately into the fund and is invested within International Financial Market. The funds withdrawals are severely limited, with the Government only allowed to remove less than the annual expected returns of the fund. Since 2019, it has grown to over $1.16 Trillion USD, providing over $250,000 USD per citizen, mainly within equities and fixed-income securities, however recently the fund has put forward 5% for low-income housing and real-estate.

The Fund also stands as the largest “impact investor” in the world, essentially focusing on sustainable investments which aim to future proof the economy and mitigate long-term risks. The Fund excludes companies which go against the UN Ethical and Sustainable Development Goals. Companies have been historically excluded for their environmental damage, support of nuclear weapons and carcinogenic products such as Rio Tinto, Northop Grumman and Phillip Morris.

The benefits of this restricted economic exploitation have allowed other sectors of the economy to continually develop, allowing the nation to offer high levels of government benefits namely sickness and disability payments, universal healthcare and unemployment insurance. Compared to Venezuela, Norway has been able to provide a multitude of benefits to their citizens, while maintaining strong institutions, low corruption and a stable economic outlook

Closing Thoughts

This snapshot into economic managements, highlights how though both nations had similar natural resources, the succeeding disparity in living standards, future economic outlook and educational achievement tells a different tale. It highlights to us, the importance of diversifying one’s economy, just like an investment portfolio. Norway highlighted how instead of seeking short-term goals the economy must work for the long-term benefit and in turn fundamentally improve a nation. Norway is therefore a diamond in the rough, a system which has been modified to meet the unique challenges of the day, while aiming to continually better society for the long-term.

References

https://www.cfr.org/backgrounder/venezuela-crisis