By Yash Barve

Despite the calmness of January and February, March has proved to be the most eventful month of the year for the economic and financial world. The fall of large banks such as SVB, Signature Bank, and Credit Suisse has not only injected a new batch of market uncertainty but also major doubt over the current banking and financial regulations in place to protect the firms and people who engage in today’s evolving banking world.

SVB is the 16th Largest US bank and was founded in 1983 by Wells Fargo executive Bill Biggerstaff, Stanford professor Robert Medearis, and Roger V Smith, who was later recruited because of his experience in the high-tech lending unit in Wells Fargo. In recent years, SVB has had an increased focus on high-risk lending to capitalize on the tripling of its deposits during the post-COVID technology boom. It has focused on providing financing and banking services to both large technology companies as well as tech and healthcare startups, backing way over 50% of the newcomers into the space. Many large companies such as Etsy, Rocket Labs, Roblox, and Roku utilized SVB for holding its working capital used to pay for payroll and short term (ST) expenses. As a result, most depositors in SVB hold accounts exceeding the $250,000 in FDIC insurance provided by the government. Furthermore, during the post-pandemic boom, SVB held large amounts of liquidity to facilitate the tripling of its depositors and high demand given by the technology sector, which it was heavily invested in and as well as heavily demanded by.

SVB’s collapse is a result of both coincidence as well as structural mismanagement. The structural problems stemmed from its lack of asset diversity and asset and liability management to deal with ST account payables. In 2021, SVB made a strong move towards 10-year long-term Treasury bonds for greater yield in the market. However, when doing so, SVB managers did not protect its liabilities via the divestment into ST investments to ensure safe levels of liquidity for the bank and its depositors. This meant that the bank increased its risk of failure in the event of mass withdrawal in a short period of time, which SVB was specifically predisposed to because of the high average deposit quantity. The wind-down in the post-pandemic technology boom following the end of 2021 saw deposits within the bank begin to fall with rising concerns about liquidity with such a large quantity of deposits divested into long-term Treasury bonds. This combined with the Fed’s actions in hiking interest rates saw its bond portfolio valuation fall. This devaluation can be explained by a well-known economic concept known as the yield curve.

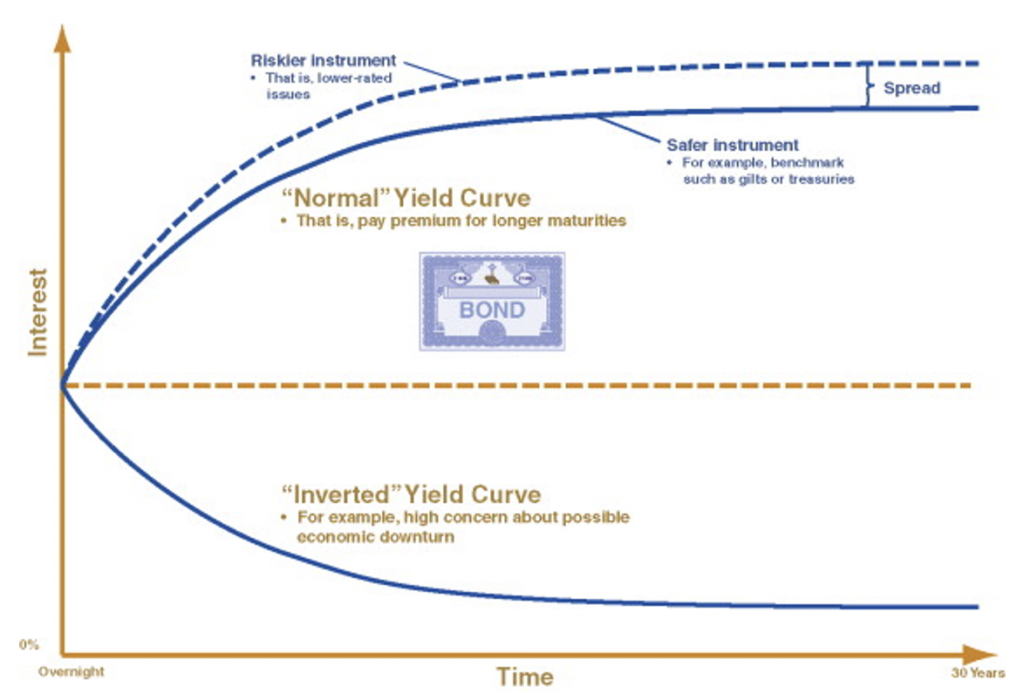

The yield curve is the graphical representation of the yields on different maturities of debt securities and is typically plotted for govt bonds. When interest rate rises the yield of new bonds increases however this means that previously issued securities will reduce in attractiveness for investors as its comparative yield is less than the new bonds that are found in the market, hence to compensate for this change in the market the bond prices must fall so the previously issued bonds can remain competitive in the second-hand bond market.

The second key component of SVB’s collapse relates more specifically to the classic bank run scenarios which realized all the potential problems the poor management of its assets created. SVB’s capital raising efforts of 1.75bn in early March and its liquidation of $21bn in bonds at a loss of $2bn created a social media panic. With news of these moves causing its stock to plunge 60% and resulting in a rapid cascade of depositors withdrawing funds. This accelerating velocity of withdrawals by SVB’s major clients ultimately finalized its collapse due to the insufficient ST liquidity of the bank.

Looking forward SVB was purchased by First Citizen’s bank on the 26th of March as approved by the FDIC. FDIC allowed First Citizen’s bank to purchase $72bn of assets from SVB at a discount which removed 16.5bn off the sticker price while the FDIC maintained control of $90bn of the remaining assets in its receivership. All 17 of SVB’s branches were integrated with First Citizens Bank. With fallout of SVB’s collapse costing the market $20bn.